The Ultimate Guide To Hsmb Advisory Llc

The Ultimate Guide To Hsmb Advisory Llc

Blog Article

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

Table of ContentsIndicators on Hsmb Advisory Llc You Should KnowNot known Facts About Hsmb Advisory LlcHow Hsmb Advisory Llc can Save You Time, Stress, and Money.Things about Hsmb Advisory LlcThe 4-Minute Rule for Hsmb Advisory LlcThe Greatest Guide To Hsmb Advisory LlcThe Facts About Hsmb Advisory Llc Uncovered

Be aware that some policies can be costly, and having specific health problems when you use can enhance the premiums you're asked to pay. You will certainly need to make certain that you can manage the costs as you will need to dedicate to making these repayments if you want your life cover to remain in locationIf you feel life insurance policy could be valuable for you, our collaboration with LifeSearch enables you to get a quote from a number of carriers in double fast time. There are different kinds of life insurance policy that intend to fulfill various security needs, including level term, decreasing term and joint life cover.

Hsmb Advisory Llc Can Be Fun For Everyone

Life insurance policy provides 5 monetary benefits for you and your household (Insurance Advisors). The major advantage of including life insurance coverage to your economic strategy is that if you pass away, your heirs receive a swelling amount, tax-free payment from the policy. They can utilize this money to pay your final costs and to replace your revenue

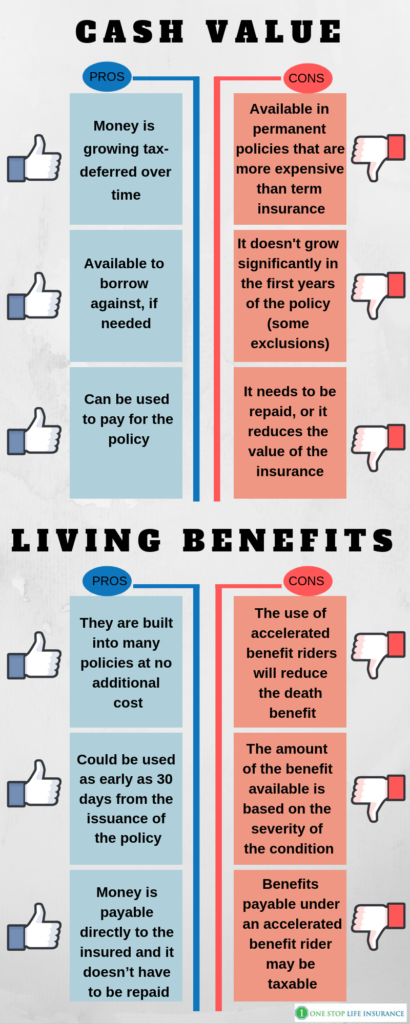

Some plans pay out if you create a chronic/terminal illness and some supply cost savings you can use to support your retired life. In this short article, discover the various benefits of life insurance policy and why it may be a good concept to spend in it. Life insurance provides advantages while you're still to life and when you pass away.

Hsmb Advisory Llc Things To Know Before You Get This

If you have a policy (or plans) of that size, the individuals who rely on your income will still have money to cover their recurring living expenditures. Beneficiaries can utilize plan advantages to cover critical day-to-day costs like lease or mortgage settlements, energy expenses, and grocery stores. Average annual expenses for homes in 2022 were $72,967, according to the Bureau of Labor Data.

Top Guidelines Of Hsmb Advisory Llc

Development is not influenced by market problems, permitting the funds to accumulate at a stable rate gradually. In addition, the cash worth of whole life insurance policy expands tax-deferred. This implies there are no earnings taxes accumulated on the cash money worth (or its development) till it is taken out. As the cash money worth develops gradually, you can utilize it to cover costs, such as purchasing a car or making a down payment on a home.

If you determine to obtain against your money worth, the lending is exempt to revenue tax obligation as long as the plan is not given up. The insurance provider, nonetheless, will certainly bill interest on the lending amount till you pay it back (https://www.brownbook.net/business/52607786/hsmb-advisory-llc/). Insurance policy companies have differing rate of interest on these car loans

Hsmb Advisory Llc Things To Know Before You Buy

For instance, 8 out of 10 Millennials overestimated the cost of life insurance policy in a 2022 study. In actuality, the typical expense is better to $200 a year. If you assume purchasing life insurance policy might be a clever monetary relocation for you and your household, take into consideration talking to an economic advisor to embrace it right into your economic strategy.

The 5 major kinds of life insurance policy are term life, whole life, universal life, variable life, and last expenditure coverage, additionally called burial insurance. Each type has different features and advantages. Term is a lot more budget friendly yet has an expiry date. Whole life starts setting you back extra, yet can last your whole life if you maintain paying the costs.

The Best Strategy To Use For Hsmb Advisory Llc

Life insurance can additionally cover your mortgage and offer cash for your household to keep paying their costs (https://www.nulled.to/user/6100395-hsmbadvisory). If you have household depending on your revenue, you likely require life insurance policy to sustain them after you pass away.

Generally, there are 2 kinds of life insurance prepares - either term or irreversible strategies or some combination of the two. Life insurance firms offer various forms of term strategies and conventional life policies as well as "interest delicate" items which have ended up being much more common considering that the 1980's.

Term insurance policy gives defense for a specific amount of time. This duration might be as brief as one year or give insurance coverage for a specific variety of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance policy mortality tables.

Some Known Questions About Hsmb Advisory Llc.

Currently term insurance coverage prices are really competitive and among the cheapest traditionally seasoned. It needs to be kept in mind that it is an extensively held belief that term insurance is the least pricey pure life insurance policy protection offered. One requires to review the policy terms meticulously to choose which have a peek here term life alternatives are suitable to satisfy your certain situations.

With each brand-new term the costs is enhanced. The right to renew the plan without proof of insurability is an essential benefit to you. Or else, the risk you take is that your wellness may wear away and you may be unable to obtain a policy at the very same prices or perhaps in all, leaving you and your beneficiaries without protection.

Report this page